CHIPS Act Overview: What It Means for Federal Contractors

In August 2022, the U.S. government made one of the most ambitious investments in decades for the future of American manufacturing. The CHIPS and...

Discover our wide range of courses designed to help you maintain compliance with Prevailing Wage and other labor laws

Join our upcoming events to ensure seamless compliance with Prevailing Wage and other essential labor laws

Discover how our services can assist you and your company in staying compliant with Prevailing Wage.

Explore the resources we offer, providing quick guidance on a wide range of topics

3 min read

Hailey Soupiset : September 30, 2024 10:20 AM

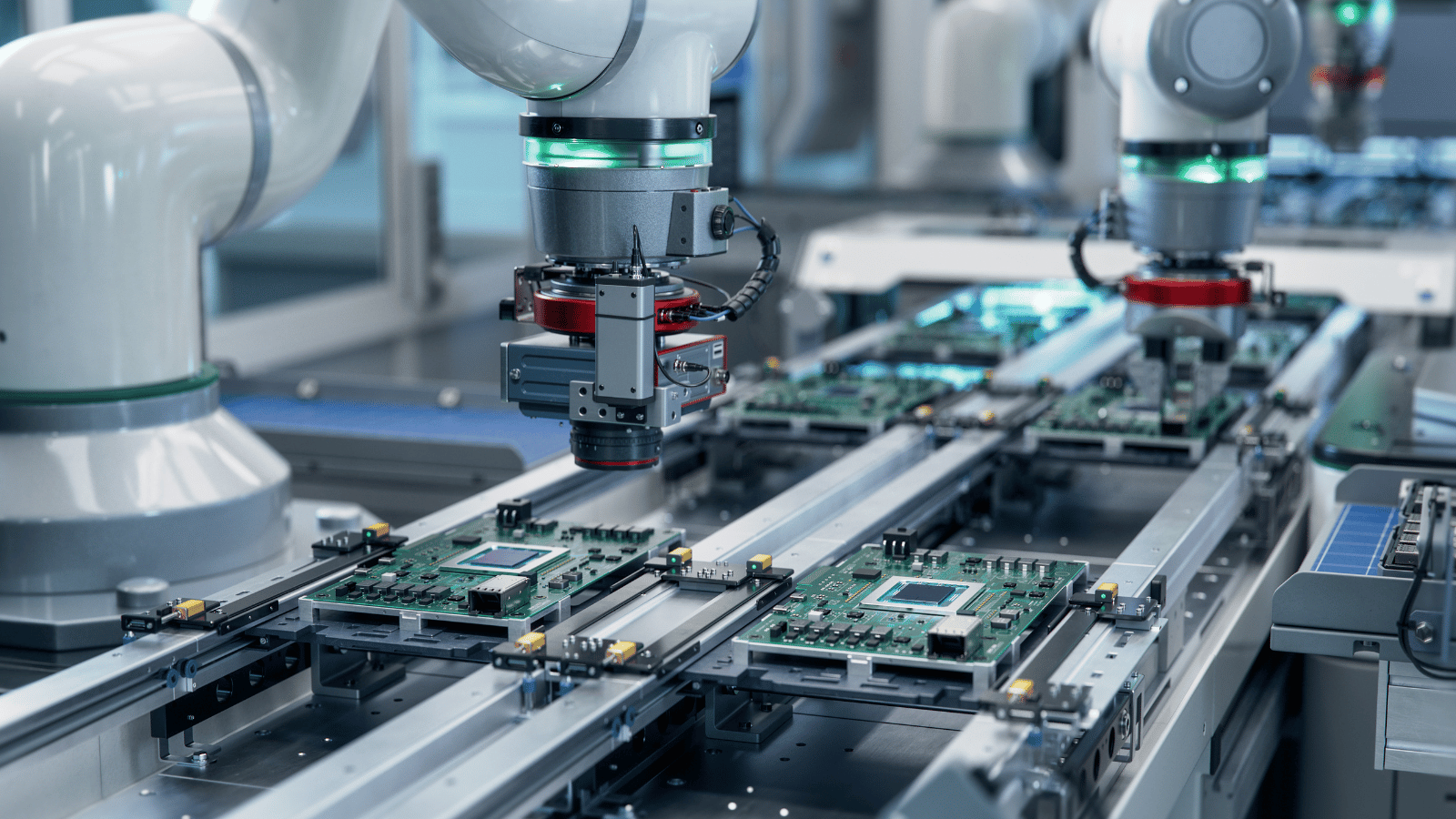

The CHIPS and Science Act (H.R. 4346), signed into law in August 2022, marks a pivotal moment for the U.S. semiconductor industry. With $52.7 billion in federal subsidies aimed at bolstering domestic semiconductor production, the CHIPS Act represents a monumental opportunity for contractors. However, with this opportunity comes with significant responsibility, particularly in complying with the Davis-Bacon Act (DBA) requirements. For contractors and subcontractors involved in CHIPS-funded projects, understanding and adhering to these federal labor laws is crucial to securing funding and avoiding severe penalties.

The CHIPS Act requires contractors on federally funded construction projects to comply with the DBA. The DBA mandates that contractors and subcontractors pay workers no less than the locally prevailing wages for similar projects. This ensures that workers are compensated fairly and helps maintain a level playing field in the construction industry.

This isn't the first time such compliance requirements have been imposed. During the Obama administration, the American Recovery and Reinvestment Act of 2009 (ARRA) included nearly identical provisions. Contractors were required to adhere to all DBA obligations, not just the prevailing wage stipulations. The Biden administration has taken a similar approach with the CHIPS Act, underscoring the importance of comprehensive compliance.

Contractors seeking CHIPS Act funding must be prepared to meet several key compliance requirements:

Both the CHIPS Act and the Inflation Reduction Act (IRA) offer significant opportunities for contractors, but they impose different compliance obligations.

The IRA, enacted in August 2022, focuses on clean energy projects and includes strict prevailing wage and apprenticeship requirements. Contractors must meet specific labor hour ratios and maintain weekly certified payrolls to qualify for tax incentives. Unlike the CHIPS Act, the IRA mandates the use of apprentices, with specific participation rules in place.

While both acts expand the DBA’s Prevailing Wage requirements, the CHIPS Act does not impose apprenticeship mandates, though contractors can use apprentices as part of their workforce. Additionally, the compliance oversight for CHIPS projects is managed by the Department of Labor (DOL), whereas the IRS oversees compliance for IRA-related initiatives.

Non-compliance with the CHIPS Act can result in severe consequences, including:

Companies that fail to meet prevailing wage standards may face correction payments, termination of contracts, and even debarment from future federal opportunities.

Maintaining accurate payroll records, apprentice participation, and other compliance documentation is essential to avoid potential fines and penalties. The lessons learned from past initiatives like ARRA highlight the importance of meticulous record-keeping and proactive compliance strategies.

As leaders in the Prevailing Wage and contracting compliance industry, Onsi Group is here to support your CHIPS Act compliance efforts. We offer a range of services tailored to the unique needs of contractors, including:

Contact us today to learn how Onsi Group can help you navigate the CHIPS Act’s compliance requirements and achieve Peace of Mind on your next project.

The CHIPS Act presents a historic opportunity to revitalize the U.S. semiconductor industry. However, with this opportunity comes the responsibility of ensuring strict compliance with federal labor laws, particularly the Davis-Bacon Act. Contractors involved in CHIPS-funded projects must be prepared to meet a range of compliance obligations, from paying prevailing wages to maintaining detailed workforce plans. By partnering with Onsi Group, you can confidently navigate these requirements and secure the funding necessary to bring your project to life.

- Hailey Soupiset & Joshua Hinckley

In August 2022, the U.S. government made one of the most ambitious investments in decades for the future of American manufacturing. The CHIPS and...

Navigating the Regulatory Maze: Government Contractors' Challenges in Balancing Federal and State Paid Sick Leave Requirements

.png)

On March 14, 2025, President Donald J. Trump issued the executive order titled "Additional Rescissions of Harmful Executive Orders and Actions,"...