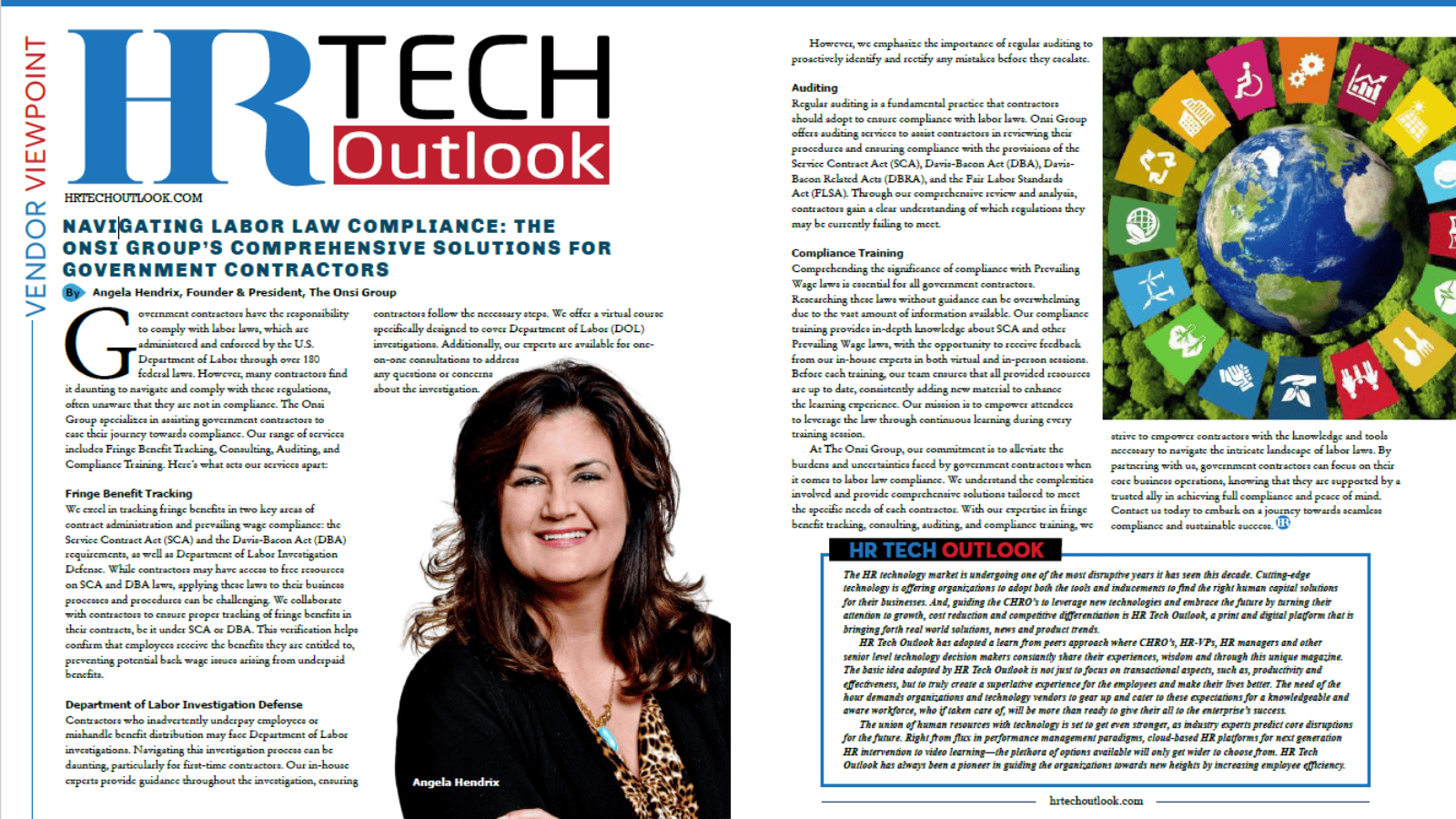

The Onsi Group’s Comprehensive Solutions for Government Contractors

Government contractors have the responsibility to comply with labor laws, which are administered and enforced by the U.S. Department of Labor through...

Discover our wide range of courses designed to help you maintain compliance with Prevailing Wage and other labor laws

Join our upcoming events to ensure seamless compliance with Prevailing Wage and other essential labor laws

Discover how our services can assist you and your company in staying compliant with Prevailing Wage.

Explore the resources we offer, providing quick guidance on a wide range of topics

2 min read

Aaron Ramos : July 31, 2023 10:56 AM

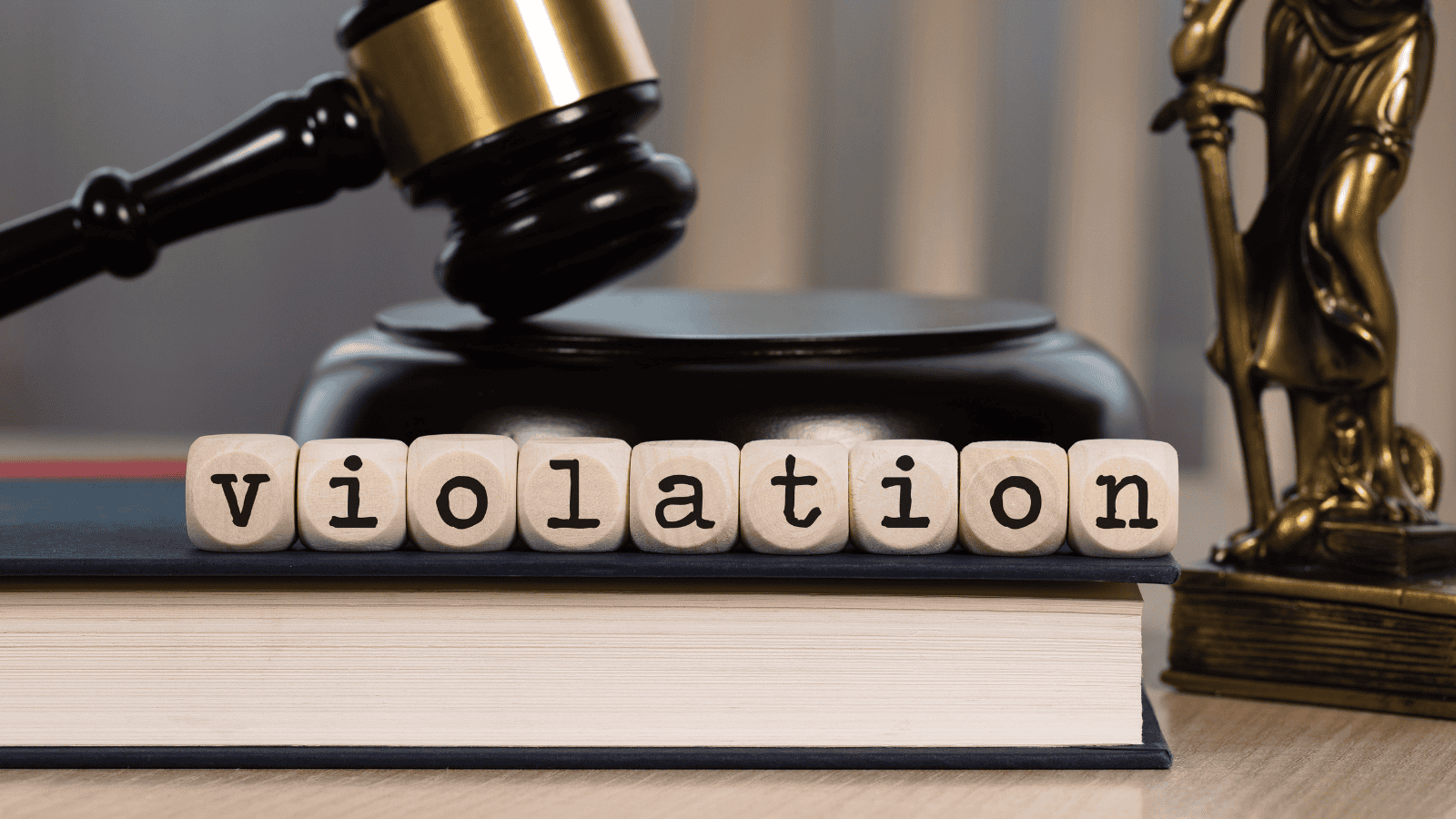

For government contractors, adherence to federal wage laws is crucial to ensure their employees receive the prevailing wage compensation and required Bonafide fringe benefits to which they are entitled, lest a complaint be filed and the find themselves on the wrong end of a DOL Investigation. The U.S. Department of Labor's Wage and Hour Division takes swift action when contractors violate these laws. This blog examines a recent case involving Perkins Management Services Co. and sheds light on the decision-making process leading to contractor debarment. Furthermore, it offers valuable insights on how government contractors can avoid similar predicaments.

Perkins Management Services Co. In April 2017, the U.S. Environmental Protection Agency awarded Perkins Management Services Co. a contract to provide food service staffing at the agency's cafeteria in Durham, North Carolina. However, an investigation conducted in 2021 exposed several violations, prompting an Administrative Law Judge (ALJ) to issue a debarment order against Perkins Management Services Co. This order barred the contractor from bidding on federal contracts for three years due to their failure to comply with the Contract Work Hours and Safety Standards Act, as well as and the Service Contract Act.

Section 5(a) of the Service Contract Act (SCA) specifies that any person or firm found to have violated the act, as determined by an ALJ hearing, is subject to debarment, unless "unusual circumstances" warrant an alternative recommendation from the Secretary of Labor. While the term "unusual circumstances" lacks a clear definition from Congress, ALJs have established its meaning and intent through their decisions.

The following criteria are evaluated by investigators to issue their debarment recommendation:

Investigations revealed multiple violations committed by Perkins Management Services Co. The company paid two cooks an hourly wage lower than the prevailing wage rates required for their occupations. Additionally, during the initial months of the contract, the employer failed to provide the cooks with required fringe benefits. Other violations included the failure to provide paid vacation to eligible workers and the payment of overtime rates lower than those legally mandated.

The Administrative Law Judge likely based the decision to debar Perkins Management Services Co. on the concept of "willfulness" as defined by the Department of Labor (DOL). Willfulness encompasses the nature, extent, and seriousness of past violations. Determining willfulness involves factors such as falsification or concealment of records, deliberate violations (such as disregarding wage determination rates and fringe benefits), intentional employee misclassification, and incorrect records. While specific details regarding the company's recordkeeping are not publicly available, it is likely that inadequate and inaccurate records played a part in the debarment decision.

The resolution of wage violations through the payment of back wages, as evidenced by Perkins Management Services Co.'s case, is not sufficient to secure debarment relief. Government contractors must constantly monitor SCA compliance policies, as noncompliance can have severe repercussions for their businesses. The Department of Labor has demonstrated its firm stance on contractor violations, leaving little room for leniency.

Onsi's Offerings: To navigate the complexities of SCA compliance effectively, Onsi provides a range of Educational Training Courses designed specifically for government contractors. These courses offer comprehensive insights into SCA compliance, ensuring contractors understand the intricacies of the regulations. In addition, Onsi offers Fringe Benefit Tracking Services, Compliance Auditing, and Consulting Services to assist businesses in maintaining compliance and reducing exposure.

If SCA compliance is giving your team a perpetual headache, email trust@onsigroup.com for further guidance.

- Aaron Ramos, Labor Compliance Officer

Government contractors have the responsibility to comply with labor laws, which are administered and enforced by the U.S. Department of Labor through...

What’s the difference between a willful and non-willful violation of DOL protocols? What are the penalties like for each? In simple terms,...

What is H&W Pay? Have you ever wondered what H&W pay is? If so, you're not alone! H&W pay refers to Health and Welfare pay, which is a vital aspect...